FinTech Solutions

Reinventing Financial Innovation: AI, Digital Transformation & Engineering for FinTech

Enable secure, compliant, lightning-fast FinTech innovation—powered by Sariv’s AI and end-to-end digital engineering services.

FinTech Industry Challenges

- Lengthy, high-friction KYC/onboarding

- Inaccessible, incomplete customer credit data

- Growing fraud and risk complexity

- Ever-changing regulation (RBI, GDPR, SEBI, PCI DSS)

- Siloed legacy systems, downtime, scaling pains

- Cloud costs and infrastructure inefficiency

What We Deliver

AI for FinTech – Security, Speed & Smart Decisions

We believe in successful go to market execution is key to revenue growth. We can help you to deliver brand awareness in engagement business performance.

Why Sariv for FinTech?

- Pan-India & global compliance know-how

- Past client outcomes: 80% onboarding time cut, near-zero fraud, 50% lower ops cost

- True partnership: Co-build and continuously improve

AI-Driven Solutions

- Alternative data and ML-driven credit scoring

- Real-time fraud, AML, and risk monitoring

- Personal finance robo-advisory and bots

- Document/KYC automation (OCR + facial recognition)

Digital Transformation

- Legacy modernization, microservices, and new portals

- Process automation (loan, payments, support)

- Open banking enablement and API strategy

- Cloud migrations and compliant data lakes

Engineering & DevOps

- Custom product development (wallets, lending, brokerage)

- Security & compliance engineering

- Infrastructure as code, CI/CD, reliability optimization

Process Optimization

- Transaction speed/reliability tuning

- Continuous cloud cost audits

- Workflow reengineering for speed and accuracy

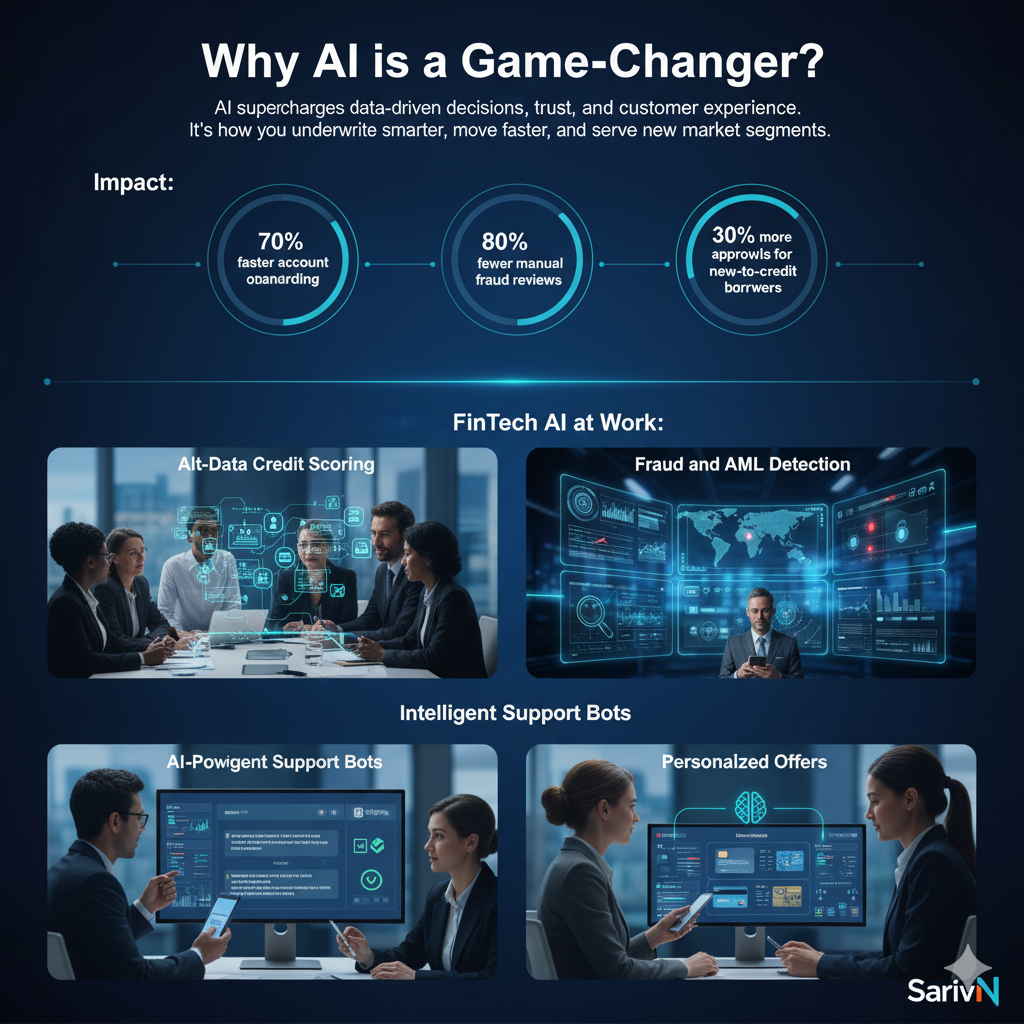

Why AI is a Game-Changer?

AI supercharges data-driven decisions, trust, and customer experience. It’s how you underwrite smarter, move faster, and serve new market segments.

Impact:

- 70% faster account onboarding

- 80% fewer manual fraud reviews

- 30% more approvals for new-to-credit borrowers

Sariv’s FinTech AI at Work:

- Alt-Data Credit Scoring: Approve the “unbanked” with AI pattern recognition

- Fraud and AML Detection: Machine learning models hunt anomalies in real time

- AI-Powered KYC: Automated ID checks, facial verification, and government DB cross-checks

- Intelligent Support Bots: Fast, round-the-clock response to customer and agent queries

- Personalized Offers: Predictive matching for lending, cards, insurance, and investments